How The Liberals Swiftboated the Nova Scotia Film Industry

The term “swiftboating” entered our modern political lexicon when the organization “Swift Boat Veterans for Truth” conducted a widely publicized, and later completely discredited, smear campaign attacking the combat record of 2004 U.S. Democratic presidential candidate Senator John Kerry, who had served with distinction in the Vietnam War (he was awarded a Silver Star and a Bronze Star for bravery, as well as three Purple Hearts for injuries sustained during combat operations). The term has since come to be used to describe particularly egregious political attacks that are unfair and untrue.

Swiftboating represents modern politics at its absolute worse. Perfected by George W. Bush’s practitioners of the political dark arts (Karl Rove et al), it is used by politicians who want to distract the general public from the real facts of an issue (in Bush’s case, his own failure to serve in a combat role in Vietnam) by spreading false information about their opponents (impugning Kerry’s bona fide heroism). The technique relies on the first rule of political propaganda, which is to tell a lie (the bigger the better), and then keep repeating it. Don’t bother people with the actual facts so that they can make an informed decision – give them your decision and then provide them with a narrative, no matter whether it is true or not, that leads them to support that decision. It is a practice that is antithetical to the most basic principles upon which our democratic system of government is based. It epitomizes bad governance, and a lack of good faith between the politicians who use it and the citizens against whom (and also to whom) it is targeted.

Unfortunately for Nova Scotians, the public relations campaign waged by the Liberal government of Stephen McNeil against the film and television industry in this province over the past year has been a textbook example of Swiftboating.

It began when then Finance Minister Diana Whalen made a pre-budget speech to the Halifax Chamber of Commerce on March 25, 2015. In her remarks, which warned of austerity measures to come, she singled out the film tax credit in particular as a program that was “under review” (usually a political euphemism for “on the chopping block”). According to Whalen, the program “costs taxpayers $24 million dollars a year. With it, Nova Scotia tax payers pay up to 65 percent of the eligible salaries for film and television projects. Now by contrast, our payroll rebate program for other industries are capped at 8 to 10 percent for eligible salaries. Surprisingly, within the rules, there is no requirement to film in Nova Scotia. It may be called a tax credit, but it isn’t used to offset taxes that are owed. 99 percent of the money is being paid directly to companies that don’t owe taxes in Nova Scotia.”

In one speech, Whalen had portrayed the film and television industry as a group of money-grubbing fat cats who cost the Province $24 million based on a super-rich subsidy and who had no obligation to even film or pay taxes here. She might as well have included a picture of Scrooge McDuck lounging in his money bin with “Nova Scotia Film Industry” plastered all over it.

The problem was that her statement was a gross distortion of the facts.

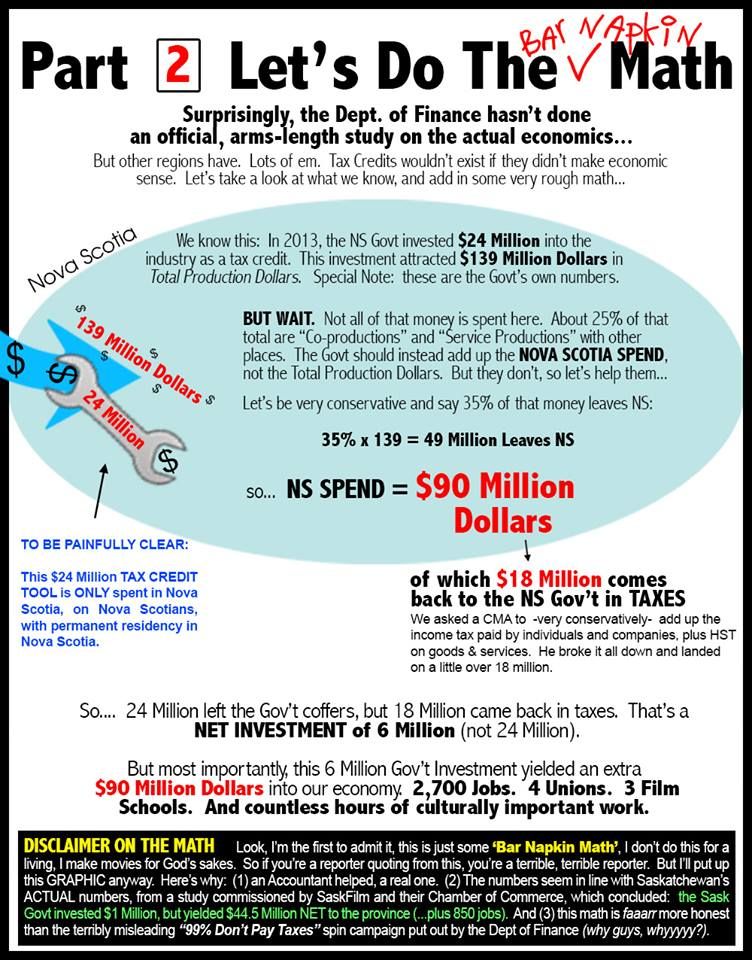

Let’s start by taking a look at her assertion that the tax credit “cost $24 million”. Yes, that was the amount that the Department of Finance stated had been paid out in the previous fiscal year and estimated would be paid out in the upcoming fiscal year, but that figure did not take into account the taxes paid back into the provincial treasury by film industry employees, companies, and also HST. Whalen provided the public with the gross number, which was meaningless (other than as a tool to create a bad impression), as opposed to the net number, a reasonable estimate of which stands between $6 and $8 million (see below). She also did not take into account the monies returned to the provincial treasury from the spin-off revenue generated by film production. Furthermore, there was no mention of the fact that the government’s own internal figures showed the industry generated between $100 million and $150 million in production activity in Nova Scotia, depending on the year.

And yet it was the $24 million number that became the one reported by every media outlet, despite being demonstrably false to meet the purpose for which it was being offered. Why? Because it was the first number introduced to the public, because it was easy to grasp, and because no matter how many times industry representatives pointed out it was flawed the government just kept repeating it.

Whalen’s focus on the rate of the tax credit (up to 65%) and her comparison with other government payroll rebates was also deeply misleading. The proper comparison – and the one that Nova Scotian governments had used for twenty years in order to assess whether or not the film tax credit was pegged at a reasonable rate – was with other jurisdictions in Canada and the United States that had a film tax credit system. With a base rate of 50% at the time of last year’s budget (the 65% only applied to productions which qualified for regional and frequent filming incentives), there was no question that Nova Scotia’s rate was near the top end of the scale. But given the competitive disadvantages that Nova Scotia faces in the global film industry marketplace, particularly our distant location from major production centers, and small population, the rate itself was not inherently unreasonable. Even if one thought the rate was too high, however, the simple answer would have been to adjust it to a rate that was considered reasonable, a process that had been employed more than once by different governments over the past twenty years as they raised and lowered the credit as circumstances changed. But those governments always respected the unique circumstances of the film industry, and understood that comparing the film tax credit rate with payroll rebate rates offered to industries like banking was like comparing apples to aardvarks, i.e it was intellectually dishonest.

Nonetheless, the “we’re paying 65 cents on the dollar” narrative had been established in the minds of the general public, and it too was repeated at every turn by the government as a way to discredit the value of the industry. Just one of the myriad examples occurred when several film industry representatives appeared before the House Committee on Economic Development, and Liberal MLA Iain Rankin made the following statement – masquerading as a question – which directly parroted the Liberal line of attack begun by Whalen eight months earlier: “The old program, as you know and alluded to, was 65 per cent of the wages that were being subsidized. The new incentive fund still has 25 per cent of an incentive for an all spend. So given the fact that payroll rebates are around the 10 per cent and below level – so the old program was actually six times more heavily subsidized – in your view, what makes one job in the film industry more valuable to the province than the industries where they have incentives?” The film producers testifying in good faith before the Committee were understandably angry.

The most egregious line in Whalen’s speech to the Chamber of Commerce, however, and the one most damaging to the public perception of the film and television industry, was her comment about how there was no obligation that companies film or pay taxes in Nova Scotia. While technically true on its face, this statement was so completely out of context that it constituted a gross and deliberate misrepresentation of the mechanics of the tax credit system.

Take the part about companies not paying taxes first. Companies that accessed the tax credit were structured as single purpose companies, created solely for the purpose of running the production and then accessing the financing triggered by that production, including the tax credit. They were self-contained entities, and when the production was finished and everything had been paid, the single purpose production company would be wrapped up and the rights to the production would invariably be transferred to the parent company. This was how everyone involved in the system wanted it to work – from government itself to the banks that interim financed the loans producers would take out to cover the tax credits until they were paid well after the production ended. The whole point of the system was that a particular production’s costs would balance with its expenditures so that at the end of the day the single purpose production company would owe no taxes, which meant that the tax credit (which was effectively a labour rebate) would be paid out in its entirety. This is the system that was set up by the government.

So while it’s true that the single purpose production companies would almost never pay taxes, because they and the system were designed that way, Whalen’s statement ignored the fact that their parent companies were required to pay taxes. Even more dishonest, however, was her failure to acknowledge that all Nova Scotia employees for whom those production companies claimed a tax credit (and the credit could only be claimed against amounts paid to Nova Scotian residents) were required to pay taxes on it. As noted above with respect to the $24 million figure she cited, her claim that the single purpose production companies did not pay taxes was only one very small part of the equation, although it was the one that when viewed out of context and in isolation made the film and television industry look bad.

Of course, one just has to look at the system the Liberals brought in to replace the tax credit to see that the whole “companies aren’t paying taxes on the money they receive” statement was a red herring offered solely to denigrate the film industry, because the new Production Incentive Fund is set up the exact same way – it is accessed by single purpose companies that will have a bottom line of zero when it comes to taxes owed!

As to the question of whether or not the films that qualified for the tax credit were shot in Nova Scotia, this was another complete sleight of hand designed to make the film industry look bad. It is true that parts of some types of productions could be shot elsewhere (and does anyone honestly believe that Whalen and the Liberals were “surprised” by this fact, as she indicated in her remarks to the Chamber of Commerce?). In the case of co-productions with other jurisdictions, filming might be divided between several different jurisdictions (the recent hit CBC mini-series The Book of Negroes, for example, was shot in Nova Scotia and South Africa); in the case of documentaries, significant portions of the filming might be done elsewhere, depending on the subject matter (my 2006 documentary Fields of Fear, for example, was about an Albertan cattle rancher who investigated mysterious animal mutilations – accordingly, a fair portion of our filming took place in Alberta, although we also did some filming in Nova Scotia).

The problem is that while this was a line calculated to reflect badly on the film industry, just like all of the others the Liberals have used, it simply wasn’t was relevant to the application of the film tax credit, which was based solely on Nova Scotia labour costs. Thus, in the case of The Book of Negroes, none of the filming done in South Africa would have been eligible for the tax credit unless there were Nova Scotia residents working there who would be returning home and paying taxes here. In the case of Fields of Fear, all of my crew were Nova Scotian residents who paid taxes here (and like almost all documentaries, our post-production was done here in Nova Scotia, a critical part of the filmmaking process that the Liberals simply never mentioned).

All of the complete numbers and facts, when placed in their proper context, painted a vastly different – and much more accurate – portrait of the reality of the film and television industry in Nova Scotia. But that wasn’t what McNeil, Whalen and the Liberals were trying to do. Their mission from the very beginning was to raise doubt about the viability of the industry and its cost to Nova Scotians. It was Swiftboating 101 – create a strawman, and then attack it; distract people from the real issues with falsehoods, out-of-context or misleading numbers, and empty rhetoric.

Here is a rough “bar napkin” approximation of how the system really worked, put together by a film industry professional who took into account all of the numbers and placed them in their proper context (and even added a humorous disclaimer).

None of this mattered to the Nova Scotia Liberal government of Stephen McNeil, however. They had a story that they were determined to sell to the people of Nova Scotia, and they were willing to twist the numbers and malign the film industry in any way possible in order to close the deal. The fact that none of it was fair, or even remotely accurate, was as irrelevant to them as the actual numbers were to their talking points.

Lest readers think that all of this has ended, don’t be fooled – the Liberals are still swiftboating the film and television industry. Just last week, for example, Stephen McNeil, when asked the perfectly reasonable question of why the Liberals had retained a tax credit for digital media and animation even as they cut the film industry tax credit, stated that digital companies create full-time jobs and full-time “bricks and mortar” businesses, whereas the film industry did not.

Leaving aside the mind-boggling absurdity of a politician in the 21st century implying that only “bricks-and-mortar” businesses should be receiving tax credits, the Premier’s statement was completely and demonstrably false, like so many others he and his colleagues in government have made over the past year about the film and television industry. Halifax-based producer John Wesley Chisholm, whose company makes such critically-acclaimed programs as Hope For Wildlife, held an “existential press conference” last Friday, wherein he introduced the media to the thirty-two full-time employees that he has working at Arcadia Entertainment (which, it is worth noting, is an actual “bricks and mortar” business, located on Quinpool Road in Halifax).

Of course, the real problem with McNeil’s statement is that he uses an irrelevant term – “full-time jobs” – when, if he wanted to be honest, he should have used the “full-time equivalent” or FTE statistic that indicates the workload of an employed person in a way that makes workloads comparable across various contexts (an FTE of 1.0 is equivalent to a full-time worker). This kind of metric is imperative for an industry where many of the employees are independent contractors, moving from project to project. For example, the director of photography on my feature film Exit Thread worked for me for six weeks last summer in pre-production and production. Prior to that, he was working as the gaffer on a television series, and as soon as filming was complete on my film he went to work as a gaffer on another series. Such is the nature of life as an independent contractor; to imply he was some kind of part-time or seasonal employee is as incorrect as it is deeply insulting.

Like all of the actual statistics involved in the film industry debate, the numbers for FTEs are easy to find if one bothers to look. For example, the Canadian Media Production Association’s 2013 Economic Report on the Screen-based Media Production Industry in Canada, which drew its figures from CAVCO, the CRTC, CBC/Radio-Canada, the Association of Provincial Funding Agencies and Statistics Canada, found that there were 1,900 direct and spin-off FTE jobs in Nova Scotia as a result of the film and television industry (800 direct, 1,100 spin-off) – more than any province other than Ontario, Quebec, British Columbia and Alberta.

Needless to say, those numbers were never referenced by the government. The result is that the FTE numbers look radically different today, as jobs have disappeared and many film and television workers have either left the province or had to seek alternative employment. The fault for this lies solely with the McNeil government, which has waged a fundamentally dishonest public relations campaign against the film and television industry over the past year that is designed to convince the general public that the government’s devastating cuts to the industry were actually in the best interests of the province.

Nova Scotians deserve better.

Paul Andrew Kimball

Latest posts by Paul Andrew Kimball (see all)

- McNeil Government’s Culture Action Plan – All Talk, No Action - February 23, 2017

- “First Features” Film Series Begins at Dalhousie Art Gallery - January 17, 2017

- View 902 Podcast Episode 3 – Silver Donald Cameron - January 5, 2017

What’s really scary here is the dishonesty and (is there any other name for it but) malfeasance this government has shown on this important issue. They have other vital matters to deal with – most notably public health care. Is this the standard of governance and integrity we can expect for those as well?

Darrell Dexter and Rodney MacDonald before him certainly made their mistakes, but the way this issue was mismanaged and continues to be denied and stonewalled by the Liberals is positively breathtaking.

The government are a bunch of incompetent, lying a****.

well, at least RBC is still doing good, thank the Lord, RBC will save us all!